Accounting ERP sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This comprehensive exploration delves into the multifaceted world of enterprise resource planning systems as they pertain to accounting departments. We will navigate through the core functionalities, strategic implementation, advanced reporting, cloud-based solutions, integration capabilities, and future trends that define modern accounting ERP systems.

Understanding the profound impact of accounting ERP is crucial for any business aiming for operational excellence and informed decision-making. This guide will illuminate how these integrated systems transform financial data management, optimize processes, enhance strategic insights, and foster agility in today’s dynamic business landscape. From streamlining daily operations to forecasting future market trends, the power of accounting ERP is undeniable.

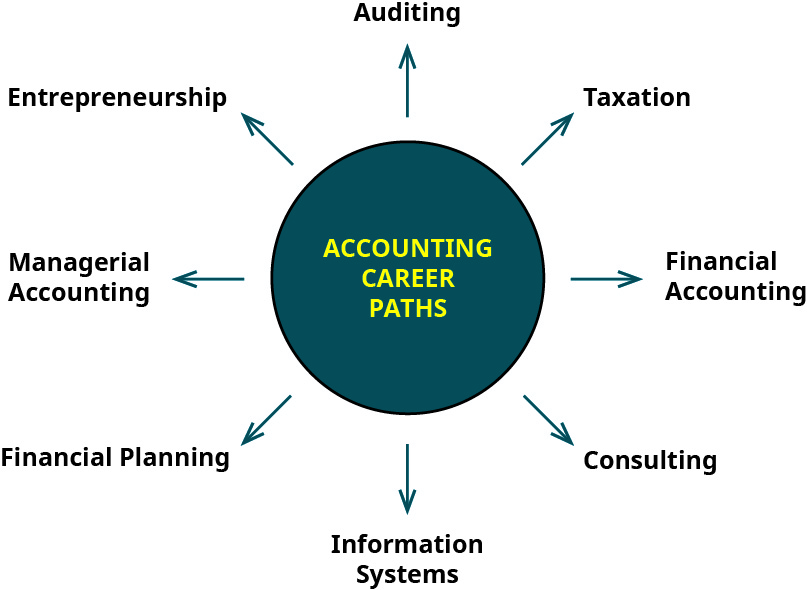

Understanding the Core Functionality of Enterprise Resource Planning Systems in Accounting Departments

Enterprise Resource Planning (ERP) systems have revolutionized how businesses manage their operations, and their impact on accounting departments is particularly profound. At its heart, an accounting ERP is designed to integrate and automate a wide range of financial processes, moving away from siloed, manual systems towards a unified, real-time view of an organization’s financial health. This integration is not just about efficiency; it’s about accuracy, compliance, and strategic decision-making.

By bringing together disparate financial data streams into a single platform, ERP systems provide accountants with the tools they need to perform their duties with greater precision and speed. This allows for more proactive financial management, enabling businesses to identify trends, anticipate challenges, and seize opportunities more effectively. The core value proposition lies in its ability to transform raw financial data into actionable insights, empowering accounting professionals to move beyond transactional processing and towards strategic financial stewardship.The integration of accounting functionalities within an ERP system is the cornerstone of its value proposition for financial departments.

Imagine a scenario where sales orders, purchase orders, inventory movements, and project costs are all captured and processed in real-time. An ERP system ensures that each of these transactions automatically flows into the general ledger, updating accounts payable, accounts receivable, and inventory valuations instantaneously. This eliminates the need for manual data entry and reconciliation across multiple spreadsheets or legacy systems, drastically reducing the risk of errors and inconsistencies.

Furthermore, this real-time data flow facilitates immediate financial reporting. Instead of waiting for month-end close to generate critical reports, accountants can access up-to-the-minute financial statements, balance sheets, and income statements. This agility allows for faster identification of budget variances, cash flow issues, and profitability trends, enabling management to make informed decisions with greater confidence. The ability to drill down into transaction details directly from summary reports provides a transparent audit trail, enhancing compliance and internal control.

This seamless integration fosters a single source of truth for all financial information, ensuring that every department operates with the same, accurate data, leading to better alignment and improved overall business performance.

Essential Modules in an Accounting ERP

An accounting ERP system is typically composed of several interconnected modules, each serving a distinct but complementary role in managing a company’s financial operations. These modules work in concert to provide a comprehensive financial management solution. Understanding the purpose and function of each is crucial for appreciating the system’s overall power and utility. These modules are the building blocks of a robust financial infrastructure, ensuring that every aspect of financial activity is captured, processed, and reported accurately and efficiently.The essential modules commonly found in an accounting ERP include:

- General Ledger (GL): This is the central repository for all financial transactions. It records debits and credits, manages chart of accounts, and produces financial statements like the balance sheet and income statement. The GL acts as the backbone of the entire accounting system, ensuring all financial activities are properly categorized and summarized.

- Accounts Payable (AP): This module manages outgoing payments to vendors. It handles invoice processing, vendor management, payment scheduling, and expense tracking. Effective AP management ensures timely payments to suppliers, helps in capturing early payment discounts, and maintains good vendor relationships.

- Accounts Receivable (AR): This module manages incoming payments from customers. It handles invoice generation, customer billing, payment tracking, and collections. A well-functioning AR module is vital for maintaining healthy cash flow and minimizing bad debts.

- Cash Management: This module provides oversight of a company’s cash position. It tracks bank balances, reconciles bank statements, manages cash flow forecasts, and facilitates treasury operations. Efficient cash management is critical for liquidity and financial stability.

- Fixed Assets: This module tracks and manages a company’s tangible and intangible assets. It handles asset acquisition, depreciation calculations, asset disposals, and reporting for fixed asset registers. Proper fixed asset management ensures accurate depreciation expense and asset valuation.

- Budgeting and Forecasting: This module supports the creation and management of financial budgets. It allows for the development of financial plans, tracking of actual performance against budgets, and forecasting future financial outcomes. This module is essential for strategic financial planning and performance monitoring.

- Financial Reporting and Analytics: While not always a separate module, this encompasses the tools and capabilities within the ERP for generating various financial reports, dashboards, and performing in-depth analysis. It transforms raw data into understandable insights for decision-making.

- Cost Accounting: This module focuses on tracking, analyzing, and managing the costs associated with producing goods or services. It includes functionalities for job costing, process costing, and activity-based costing, providing insights into product profitability and operational efficiency.

Conceptual Diagram of Financial Information Flow

Visualizing the flow of financial information through an accounting ERP system helps to demystify its integrated nature. This conceptual diagram illustrates how data originates from various operational touchpoints and converges within the ERP to form a unified financial picture. The emphasis is on the interconnectedness of modules and the seamless transfer of information, highlighting the system’s ability to maintain data integrity and provide real-time visibility.Imagine a central hub, the ERP system, with various spokes representing different business functions and modules.

At the periphery, transactions begin. For instance, a sales order is entered into a Sales module. This order, upon fulfillment and invoicing, automatically generates entries in Accounts Receivable, updating customer balances and impacting revenue recognition in the General Ledger. Simultaneously, if inventory is involved, the system updates inventory levels and potentially triggers cost of goods sold entries in the General Ledger.On the procurement side, a purchase requisition is initiated, leading to a purchase order.

Once goods are received and an invoice from the vendor arrives, it’s entered into the Accounts Payable module. This entry impacts vendor balances and, upon approval and payment, reduces cash in the Cash Management module and updates the General Ledger with the expense or asset acquisition.Project management activities generate cost data, which is fed into the Cost Accounting module and subsequently into the General Ledger, ensuring project profitability is accurately tracked.

Fixed asset acquisitions are recorded in the Fixed Assets module, impacting both the balance sheet and depreciation expenses in the General Ledger.The General Ledger acts as the ultimate destination for all these transactions, consolidating data from all other modules. From the GL, the Financial Reporting and Analytics tools can then extract information to generate real-time financial statements, budgets, and performance dashboards.

Bank transactions are fed into Cash Management for reconciliation, ensuring the GL cash balances align with actual bank statements. This continuous, automated flow ensures that the financial data is always current, accurate, and readily available for analysis and decision-making, forming a dynamic ecosystem of financial information.

Interdepartmental Interaction with the Accounting ERP

The true power of an accounting ERP lies in its ability to foster collaboration and ensure data consistency across all departments. While the accounting department is the primary custodian of the ERP, its users extend far beyond finance. Every department interacts with the system in some capacity, contributing to the creation and maintenance of unified financial records. These interactions are crucial for accurate financial reporting and operational efficiency.For example, the Sales Department is a primary source of revenue data.

When a salesperson closes a deal, the details of the sale, including pricing, terms, and customer information, are entered into the ERP’s sales order module. This directly impacts Accounts Receivable, as invoices are generated, and revenue is recognized in the General Ledger. Accurate sales data entry by the sales team is therefore critical for the accounting department’s ability to forecast revenue and manage customer accounts effectively.The Procurement or Purchasing Department plays a vital role in managing expenses and inventory.

When they initiate a purchase order for raw materials or supplies, this information is captured in the ERP. Upon receipt of goods and vendor invoices, the procurement team ensures these are accurately recorded in the Accounts Payable module. This data then flows into the General Ledger, impacting inventory valuations and expense accounts. Their diligence in matching invoices to purchase orders and receipts is essential for preventing duplicate payments and ensuring accurate cost tracking.The Operations or Production Department generates cost data related to manufacturing or service delivery.

This includes tracking labor hours, material consumption, and overhead allocation. This information is fed into the Cost Accounting module, which then feeds into the General Ledger to accurately determine the cost of goods sold and assess the profitability of production runs. Without their input, the true cost of operations would remain obscured.The Human Resources (HR) Department contributes significantly through payroll processing. When HR processes payroll, including salaries, wages, benefits, and deductions, this data is integrated with the accounting ERP.

This automates the posting of payroll expenses, taxes payable, and employee liabilities to the General Ledger, streamlining the payroll reconciliation process and ensuring accurate labor cost accounting.Even the Warehouse or Inventory Management team interacts with the ERP. Every movement of inventory – receipts, issues, transfers, and adjustments – is recorded in the system. These transactions directly impact inventory valuation in the General Ledger and can trigger reorder points, influencing purchasing decisions.

Accurate inventory tracking by this team is fundamental to correct financial reporting of asset values and cost of sales.In essence, each department acts as a feeder for financial data, and the ERP system ensures that this data is standardized, validated, and consolidated into a single, coherent financial narrative. This interdepartmental collaboration, facilitated by the ERP, is what transforms individual operational activities into comprehensive financial insights.

Optimizing Financial Processes Through Strategic ERP Implementation for Accounting

Implementing an Enterprise Resource Planning (ERP) system within an accounting department is more than just a software upgrade; it’s a strategic initiative aimed at streamlining operations, enhancing data accuracy, and providing deeper financial insights. A well-executed ERP implementation can transform how an accounting department functions, moving it from a reactive, transactional role to a proactive, strategic business partner. This transformation requires careful planning, execution, and ongoing management to ensure that the significant investment in time, resources, and technology yields the desired benefits.

Understanding the core functionalities is just the first step; the real value lies in how these functionalities are strategically leveraged to optimize financial processes.This section delves into the critical aspects of achieving successful ERP implementation in accounting, focusing on what makes these projects succeed, the hurdles commonly faced, and how to navigate them effectively. We will also explore the crucial steps involved in migrating existing data and the indispensable role of training and change management in ensuring the system becomes an integral and effective tool for the entire accounting team.

Critical Success Factors for ERP Implementation in Accounting

To ensure that an accounting ERP system delivers maximum benefit realization, several critical success factors must be meticulously addressed throughout the implementation lifecycle. These factors are interconnected and require a holistic approach, encompassing technology, people, and processes. Neglecting any of these can significantly undermine the project’s success and the return on investment. A proactive and strategic approach to these factors is paramount.

- Executive Sponsorship and Stakeholder Buy-in: Strong, visible support from senior leadership is crucial. Executives must champion the project, allocate necessary resources, and actively participate in key decisions. This sponsorship signals the project’s importance to the entire organization and helps overcome resistance. Equally important is securing buy-in from all relevant stakeholders, including accounting staff, IT, and other departments that interact with financial data. Their input during the planning and testing phases is invaluable.

- Clear Project Scope and Objectives: Defining a precise scope and setting measurable objectives are fundamental. Ambiguity in scope can lead to “scope creep,” where the project expands beyond its initial boundaries, causing delays and budget overruns. Objectives should align with the overall business strategy and clearly articulate what the ERP system is expected to achieve for the accounting department, such as reduced closing times, improved reporting accuracy, or enhanced compliance.

- Adequate Resource Allocation: Successful implementations require dedicated resources, both financial and human. This includes a skilled project team, sufficient budget for software, hardware, training, and potential external consultants. Underestimating resource needs is a common pitfall that can derail even the best-laid plans.

- Effective Project Management: A robust project management methodology is essential for keeping the implementation on track, on time, and within budget. This involves detailed planning, regular progress monitoring, risk management, and clear communication channels. Experienced project managers can navigate the complexities of ERP deployments.

- Data Quality and Migration Strategy: The accuracy and completeness of financial data are non-negotiable. A well-defined data migration strategy, including data cleansing and validation, is critical before and during the transition. Poor data quality will lead to inaccurate reports and undermine user trust in the new system.

- Comprehensive User Training and Change Management: Users must be adequately trained to utilize the ERP system effectively. A proactive change management strategy is equally important to address user resistance, communicate benefits, and foster adoption. Without this, even the most advanced system can go underutilized.

- Thorough Testing and Validation: Rigorous testing at various stages, including unit testing, integration testing, and user acceptance testing (UAT), is vital to identify and rectify issues before go-live. This ensures the system functions as intended and meets business requirements.

- Post-Implementation Support and Continuous Improvement: The implementation doesn’t end at go-live. Ongoing support, performance monitoring, and a commitment to continuous improvement are necessary to maximize the long-term benefits of the ERP system. This includes regular updates, system optimizations, and addressing user feedback.

Common Challenges in Accounting ERP Transition and Mitigation Strategies

Transitioning to a new accounting ERP system is often fraught with challenges that can test the patience and resources of any organization. These hurdles, if not anticipated and addressed proactively, can lead to project delays, budget overruns, and user dissatisfaction. Understanding these common pitfalls is the first step towards effective mitigation.The transition period can be particularly demanding due to the sensitive nature of financial data and the critical role accounting plays in business operations.

Overcoming these challenges requires a strategic, well-planned, and communicative approach.

- Data Migration Issues: One of the most significant challenges is migrating existing accounting data from legacy systems to the new ERP. This often involves dealing with disparate data formats, incomplete records, and data inconsistencies. Mitigation: Implement a phased data migration plan with thorough data cleansing and validation processes. Start with a pilot migration of a subset of data to identify and resolve issues early.

Utilize data mapping tools and involve data owners in the validation process to ensure accuracy.

- User Resistance to Change: Employees may be hesitant to adopt new technology, fearing job displacement, increased workload, or a steep learning curve. This resistance can manifest as decreased productivity or outright refusal to use the new system. Mitigation: Develop a comprehensive change management plan that includes clear communication about the benefits of the ERP system, early and continuous user involvement, and addressing concerns transparently.

Involve key users as champions to influence their peers.

- Inadequate Training: Insufficient or ineffective training can leave users unprepared to operate the new system, leading to errors and frustration. Mitigation: Design a multi-faceted training program tailored to different user roles. This should include hands-on exercises, simulations, and ongoing support. Consider different learning styles and provide access to training materials for future reference.

- Scope Creep: Uncontrolled expansion of project requirements beyond the initial scope can lead to delays and increased costs. Mitigation: Establish a strict change control process. All proposed changes to the scope must be formally reviewed, assessed for their impact on timeline and budget, and approved by a designated change control board.

- Integration Complexities: Integrating the ERP system with other existing business applications (e.g., CRM, inventory management) can be technically challenging and time-consuming. Mitigation: Thoroughly map out integration points during the planning phase. Conduct extensive integration testing to ensure seamless data flow between systems. Work closely with vendors of both the ERP and integrated systems.

- Underestimation of Time and Resources: Many projects underestimate the time, effort, and budget required for a successful implementation, leading to rushed phases and compromises. Mitigation: Conduct a realistic assessment of project requirements, involving experienced personnel and potentially external consultants. Build in contingency buffers for both time and budget to account for unforeseen issues.

- Lack of Executive Sponsorship: Without strong support from senior leadership, projects can lose momentum, face resource constraints, and struggle to gain organizational buy-in. Mitigation: Ensure active and visible executive sponsorship from the outset. Regular updates to leadership and their involvement in key decisions are vital for maintaining momentum and overcoming obstacles.

Phased Approach for Migrating Accounting Data to a New ERP System

Migrating existing accounting data into a new ERP system is a critical and often complex undertaking that demands meticulous planning and execution to maintain data integrity. A phased approach breaks down this large task into manageable stages, reducing risk and allowing for validation at each step. This structured method ensures that historical financial information is accurately and completely transferred, forming a reliable foundation for the new system’s operations.The integrity of financial data is paramount, as it underpins all financial reporting, decision-making, and compliance activities.

A poorly executed data migration can lead to inaccurate financial statements, audit issues, and a loss of confidence in the new ERP system. Therefore, a carefully orchestrated migration strategy is indispensable.A typical phased approach for migrating accounting data might involve the following stages:

- Data Assessment and Cleansing:

- Objective: To understand the current state of accounting data and prepare it for migration.

- Activities: Identify all data sources (e.g., general ledger, accounts payable, accounts receivable, fixed assets, payroll). Analyze data quality, identify duplicates, inconsistencies, and obsolete information. Develop a data cleansing plan to correct errors, standardize formats, and remove redundant data. This is often the most time-consuming but crucial phase.

- Data Mapping and Transformation:

- Objective: To define how data from the old system will correspond to fields in the new ERP.

- Activities: Create detailed data mapping documents that specify the source field, target field, and any transformation rules required. For example, a ‘customer ID’ in the old system might need to be transformed into a different format or concatenated with other information in the new ERP. This phase requires close collaboration between business users and IT.

- Pilot Data Migration:

- Objective: To test the migration process and validate the transformed data on a smaller scale.

- Activities: Select a representative subset of data (e.g., data for a specific period, a few key accounts, or a limited number of vendors/customers). Execute the migration process using the defined mapping and transformation rules. Thoroughly validate the migrated data in a test environment of the new ERP system.

- Data Validation and Reconciliation:

- Objective: To ensure the accuracy and completeness of the migrated data.

- Activities: After the pilot migration (and subsequent full migrations), conduct rigorous validation. This involves comparing key financial figures (e.g., total accounts receivable balance, total general ledger balances) between the old and new systems. Use reconciliation reports to identify any discrepancies and investigate their root causes.

- Full Data Migration:

- Objective: To migrate all remaining historical and current accounting data.

- Activities: Once the pilot migration and validation are successful, proceed with migrating the rest of the data. This is often performed during a planned downtime period to minimize disruption and ensure data consistency.

- Post-Migration Verification and Archiving:

- Objective: To confirm the integrity of the complete dataset and manage historical records.

- Activities: Perform final verification checks on all migrated data. Once confirmed, the legacy data can be archived according to retention policies, ensuring it remains accessible if needed for historical reference or audit purposes.

Each of these stages requires clear documentation, defined responsibilities, and robust testing protocols to safeguard data integrity throughout the transition.

Importance of User Training and Change Management for ERP Adoption

The most sophisticated accounting ERP system is only as effective as the people who use it. Therefore, comprehensive user training and a robust change management strategy are not merely supplementary components of an ERP implementation; they are foundational pillars that determine the system’s widespread adoption and the proficiency with which it is used. Without them, even the best-designed software can fail to deliver its intended value, leading to underutilization, errors, and ultimately, a poor return on investment.The transition to a new ERP system often represents a significant shift in how accounting professionals perform their daily tasks.

This can be met with apprehension, resistance, or simply a lack of understanding. Effective training and change management address these human elements directly, ensuring a smoother and more successful integration of the new technology into the organizational workflow. User Training: Equipping the Workforce for SuccessEffective user training goes beyond simply demonstrating how to click buttons. It involves imparting a deep understanding of the system’s functionalities, how they apply to specific job roles, and the broader business processes they support.

- Tailored Training Programs: Training should be customized to the specific roles and responsibilities of different user groups within the accounting department. A general ledger accountant will need different training than an accounts payable clerk or a financial analyst.

- Hands-on Practice: Theoretical training is insufficient. Users need ample opportunities to practice using the system in a safe, simulated environment (a training or sandbox environment) to build confidence and muscle memory.

- Role-Based Scenarios: Training exercises should mirror real-world accounting tasks and scenarios that users will encounter in their daily work. This makes the learning process more relevant and practical.

- Ongoing Support and Refresher Courses: The initial training is just the beginning. Providing ongoing support through help desks, documentation, and periodic refresher courses ensures that users can address challenges and stay up-to-date with system enhancements.

- Competency Assessment: Implementing mechanisms to assess user competency after training helps identify areas where additional support or training might be needed.

Change Management: Navigating the Human Element of TransitionChange management focuses on preparing, equipping, and supporting individuals to successfully adopt the change in order to drive organizational success and realize the benefits of the ERP system.

“Change management is about helping people embrace the new way of working, not just learn the new tools.”

- Clear Communication: Consistent and transparent communication about the reasons for implementing the ERP, its benefits, the implementation timeline, and expectations is crucial. This helps alleviate anxieties and build anticipation.

- Stakeholder Engagement: Involving key users and stakeholders from the early stages of the project fosters a sense of ownership and reduces resistance. Their feedback during design and testing phases is invaluable.

- Addressing Concerns and Resistance: Actively listening to user concerns and addressing them openly and honestly is vital. Resistance often stems from fear or a lack of understanding, which can be mitigated through dialogue and support.

- Leadership Advocacy: Visible and active support from senior management signals the importance of the ERP system and encourages employees to adopt it. Leaders should champion the change and lead by example.

- Reinforcing New Behaviors: Recognizing and rewarding users who effectively adopt the new system and processes helps to reinforce the desired behaviors and encourages others to follow suit.

- Post-Implementation Feedback Loops: Establishing channels for ongoing feedback after go-live allows for continuous improvement and ensures that the system continues to meet user needs and business objectives.

By prioritizing both comprehensive user training and a proactive change management strategy, organizations can significantly increase the likelihood of achieving widespread adoption, maximizing user proficiency, and ultimately realizing the full strategic benefits of their accounting ERP investment.

Enhancing Decision-Making with Advanced Reporting and Analytics from Accounting ERPs

Moving beyond basic bookkeeping, modern accounting ERP systems are powerful engines for strategic decision-making. They transform raw financial data into actionable insights, enabling businesses to navigate complex markets with greater confidence and foresight. This shift from reactive data processing to proactive strategic analysis is a cornerstone of effective financial management in today’s dynamic business environment.An accounting ERP system acts as a central hub for all financial operations, integrating data from various departments.

This consolidation allows for the generation of a wide array of reports and dashboards that offer a comprehensive view of the company’s financial health. These tools are not just for reporting past performance; they are designed to illuminate trends, identify potential risks and opportunities, and provide the data necessary for informed strategic planning.

Financial Reports and Dashboards for Strategic Decision Support

The reporting and dashboard capabilities of an accounting ERP are designed to cater to a diverse range of stakeholders, from operational managers to executive leadership. These tools go far beyond standard profit and loss statements, offering dynamic and customizable views that can be tailored to specific analytical needs. The ability to drill down into granular data while also maintaining a high-level overview is crucial for effective strategic decision-making.Key reports and dashboards commonly generated by accounting ERPs include:

- Financial Statements: While fundamental, ERPs offer enhanced versions of Balance Sheets, Income Statements, and Cash Flow Statements, often with comparative periods (year-over-year, quarter-over-quarter) and variance analysis built-in. These can be segmented by business unit, product line, or geographical region for deeper insights.

- Budget vs. Actual Reports: These reports are vital for performance monitoring and control. They highlight deviations from planned expenditures and revenues, allowing management to investigate discrepancies and take corrective actions promptly. ERPs can often integrate with budgeting modules for seamless comparison.

- Key Performance Indicator (KPI) Dashboards: These visual displays offer at-a-glance summaries of critical financial metrics such as gross profit margin, operating expense ratio, accounts receivable turnover, inventory turnover, and customer acquisition cost. Customization allows for the display of the most relevant KPIs for different roles within the organization.

- Sales and Revenue Analysis Reports: These reports break down sales performance by customer, product, salesperson, and region, identifying top performers and areas for improvement. They can also forecast future revenue based on historical data and current sales pipelines.

- Expense Management Reports: Detailed breakdowns of operational expenses, categorized by department, project, or expense type. This helps in identifying areas of overspending and opportunities for cost reduction.

- Accounts Receivable and Payable Aging Reports: Crucial for cash flow management, these reports show outstanding invoices and bills, categorized by how long they have been outstanding. This helps in prioritizing collection efforts and managing payment obligations.

- Profitability Analysis Reports: These reports analyze the profitability of products, services, customers, or projects, providing insights into which areas are driving the most value and which may be underperforming.

- Compliance and Audit Reports: ERP systems facilitate the generation of reports required for financial audits and regulatory compliance, ensuring accuracy and completeness of financial records.

The visual nature of dashboards, often employing charts, graphs, and color-coded indicators, makes complex financial data easily digestible. This allows decision-makers to quickly grasp the current situation, identify trends, and make informed choices that align with strategic objectives.

Real-Time Data Access for Agile Financial Management, Accounting erp

The ability to access and analyze data in real-time is a game-changer for financial managers. In today’s fast-paced and unpredictable economic landscape, having immediate access to up-to-the-minute financial information empowers them to react swiftly to market fluctuations, seize emergent opportunities, and mitigate potential risks before they escalate. Traditional accounting software often relies on batch processing or periodic updates, which can leave a significant lag between an event occurring and the financial data reflecting it.Real-time data access within an accounting ERP means that as transactions occur – whether it’s a sale, a purchase, a payment, or an adjustment – the financial system is updated instantaneously.

This immediacy offers several critical advantages:

- Swift Response to Market Volatility: If there’s a sudden shift in commodity prices, currency exchange rates, or customer demand, financial managers can see the immediate impact on costs, revenues, and profitability. This allows for prompt adjustments to pricing strategies, inventory levels, or hedging activities. For instance, if a key raw material price spikes unexpectedly, a manager can immediately assess its impact on product margins and decide whether to pass on the cost, absorb it, or seek alternative suppliers.

- Proactive Cash Flow Management: Real-time visibility into incoming payments and outgoing obligations enables proactive cash flow forecasting and management. Managers can identify potential shortfalls or surpluses well in advance, allowing them to arrange for financing, accelerate collections, or strategically invest surplus funds. This is particularly important for businesses managing seasonal sales cycles or facing unpredictable payment terms from clients.

- Dynamic Performance Monitoring: Key performance indicators (KPIs) can be monitored in real-time, allowing for immediate intervention if performance deviates from targets. If a sales team is falling short of its targets, or if a particular product’s sales are declining rapidly, management can receive immediate alerts and investigate the root cause, implementing corrective measures without delay.

- Improved Inventory Control: For businesses with physical inventory, real-time data on stock levels, sales, and incoming shipments helps prevent stockouts or overstocking. This directly impacts profitability by reducing carrying costs and lost sales opportunities. A sudden surge in demand for a particular item can be identified instantly, allowing for expedited reordering or reallocation of stock from other locations.

- Enhanced Customer Relationship Management: Real-time access to customer payment history and credit limits allows sales and finance teams to make informed decisions about extending credit, managing overdue accounts, and offering targeted promotions, thereby improving customer satisfaction and reducing bad debt.

- Fraud Detection and Prevention: Unusual transaction patterns can be flagged immediately, enabling quicker investigation and mitigation of potential fraudulent activities. This real-time vigilance is a significant improvement over periodic reviews where fraudulent activities might go undetected for extended periods.

In essence, real-time data transforms financial management from a retrospective review process into a dynamic, forward-looking discipline. It provides the agility needed to navigate uncertainty and capitalize on opportunities as they arise, which is indispensable for sustained business success.

Analytical Capabilities: Traditional Software vs. Modern ERPs and Predictive Insights

The evolution from traditional accounting software to modern Enterprise Resource Planning (ERP) systems represents a monumental leap in analytical capabilities, particularly concerning predictive insights. Traditional accounting software, while effective for recording and summarizing financial transactions, primarily offers historical reporting. Modern ERPs, on the other hand, leverage integrated data and advanced analytical tools to not only report on the past but also to forecast the future and prescribe actions.Here’s a comparative look at their analytical strengths:

| Feature | Traditional Accounting Software | Modern Accounting ERP |

|---|---|---|

| Data Scope | Primarily financial transaction data (general ledger, accounts payable/receivable). Data is often siloed and requires manual consolidation. | Integrates financial data with operational data from across the organization (sales, inventory, production, HR). Provides a unified, holistic view. |

| Reporting Focus | Historical reporting: Profit & Loss, Balance Sheet, Cash Flow. Primarily retrospective. | Historical, real-time, and predictive reporting. Offers trend analysis, variance analysis, and scenario planning. |

| Analytical Depth | Basic analysis: Sums, averages, basic comparisons. Limited drill-down capabilities. | Advanced analytics: Multi-dimensional analysis, segmentation, correlation analysis, statistical modeling. Extensive drill-down and drill-through capabilities. |

| Dashboards and Visualization | Limited, often static reports. Basic charts. | Dynamic, interactive dashboards with customizable KPIs, real-time data visualization, and graphical representations of trends. |

| Predictive Capabilities | None. Relies on manual forecasting based on historical data. | Leverages historical data, AI, and machine learning to forecast future trends, identify potential risks, and suggest optimal strategies. |

| Scenario Planning | Manual and time-consuming. | Automated and integrated. Allows for ‘what-if’ analysis for various business scenarios. |

The key differentiator lies in predictive insights. Traditional software might show you that sales declined by 10% last quarter. A modern ERP, however, can analyze factors contributing to that decline – such as changes in marketing spend, competitor activity, economic indicators, or customer churn rates – and predict the likely impact of various interventions. For example, an ERP could forecast the potential revenue increase from a targeted marketing campaign or the cost savings from optimizing inventory levels.

“Modern ERPs transform financial data from a historical record into a predictive compass, guiding strategic decisions with foresight.”

This predictive capability is powered by sophisticated algorithms and, in some advanced systems, artificial intelligence (AI) and machine learning (ML). These technologies can identify complex patterns and correlations that a human analyst might miss, leading to more accurate forecasts and more effective strategic recommendations. This proactive approach allows businesses to anticipate challenges, capitalize on emerging opportunities, and gain a significant competitive advantage.

Hypothetical Scenario: Identifying Cost Savings Through ERP Analytics

Imagine “InnovateTech Solutions,” a mid-sized manufacturing company that has recently implemented a comprehensive accounting ERP system. Before the ERP, their financial reporting was handled by a traditional accounting package, and operational data was managed in separate spreadsheets, leading to delays in analysis and a lack of integrated insights.The company was experiencing rising operational costs, particularly in its manufacturing division, and senior management was concerned about declining profit margins.

They tasked the finance department with identifying significant cost-saving opportunities.Using the newly implemented accounting ERP, the finance team began by examining various reports and dashboards. They started with a detailed “Manufacturing Cost Breakdown” report, which integrated data from procurement, production, inventory, and labor modules. This report provided a granular view of all costs associated with producing their flagship product, “GizmoX.”The ERP’s analytical capabilities allowed them to drill down into specific cost categories.

They noticed a significant increase in the “Indirect Materials” line item over the past six months. This category included consumables like lubricants, cleaning supplies, and small tools used on the production floor. While individually these items seemed minor, their aggregate cost was substantial.Further analysis, enabled by the ERP’s ability to segment data by production line and shift, revealed that a particular production line, Line C, was consuming disproportionately more indirect materials than other lines, despite producing a similar volume of GizmoX.

The ERP’s expense tracking module also showed that requisitions for these indirect materials from Line C had increased by 25% in the last quarter.The ERP system’s reporting then allowed them to cross-reference this with maintenance logs. They discovered that Line C had experienced an unusual number of breakdowns and required more frequent lubrication and adjustments than other lines. The system flagged a correlation between equipment downtime and the increased usage of lubricants and specialized cleaning agents.By leveraging the ERP’s predictive analytics, the finance team could model the impact of proactive maintenance versus the ongoing cost of excessive indirect material consumption.

The ERP suggested that investing in a scheduled preventative maintenance program for Line C, costing an estimated $15,000 annually, could reduce the need for emergency repairs and the associated high consumption of indirect materials. The analytics predicted that this would lead to a reduction in indirect material costs for Line C by approximately $50,000 per year, alongside a significant decrease in production downtime.The ERP’s “What-If Scenario” tool was used to confirm these savings.

By inputting the proposed maintenance schedule and its expected impact on material usage and downtime, the system projected a net cost saving of $35,000 in the first year, with further potential savings in subsequent years as equipment reliability improved.This hypothetical scenario illustrates how an accounting ERP, by integrating data and providing advanced analytical tools, can move beyond simply reporting past expenses to actively identifying and quantifying cost-saving opportunities that might otherwise remain hidden within complex operational data.

The ability to drill down, correlate disparate data points, and model future outcomes is what empowers strategic decision-making and drives tangible financial improvements.

Exploring the Impact of Cloud-Based Accounting ERP Solutions on Business Agility

The landscape of business operations is constantly evolving, and with it, the tools that power our financial management. Enterprise Resource Planning (ERP) systems have long been a cornerstone for optimizing accounting processes. However, the advent of cloud computing has fundamentally reshaped how these powerful systems are deployed and utilized, ushering in an era of unprecedented business agility. This shift isn’t merely about moving software to a remote server; it’s about fundamentally transforming how accounting departments operate, interact, and respond to market dynamics.

Cloud-based accounting ERPs empower businesses to be more flexible, responsive, and efficient than ever before, directly impacting their ability to adapt to change and seize opportunities.The move to cloud-based accounting ERP solutions offers a compelling suite of advantages that directly translate into enhanced business agility. One of the most significant benefits is the inherent scalability that cloud platforms provide. Unlike on-premises systems that require substantial upfront investment in hardware and lengthy installation processes, cloud solutions can be scaled up or down with remarkable ease.

This means that as a business grows, its accounting ERP can seamlessly accommodate increased transaction volumes, more users, and expanded functionalities without the need for costly hardware upgrades or significant downtime. Conversely, during periods of contraction or seasonal fluctuations, resources can be scaled back, optimizing costs and preventing the burden of underutilized infrastructure. This dynamic scalability allows businesses to react swiftly to changing market demands and internal growth trajectories, a critical component of agility.Furthermore, accessibility is dramatically improved with cloud deployment.

Finance teams are no longer tethered to a specific physical location or a set of company-owned machines. Access to critical financial data, reporting tools, and core accounting functions is available from virtually any device with an internet connection. This liberates accounting professionals to work from home, while traveling, or from different branch offices, fostering a more flexible and distributed workforce.

This ubiquitous access ensures that critical financial tasks can continue uninterrupted, regardless of geographical constraints, which is paramount for maintaining operational continuity and responsiveness in today’s globalized business environment.

Security Measures and Compliance Considerations for Cloud-Hosted Accounting ERPs

The migration of sensitive financial data to cloud-hosted accounting ERP platforms naturally raises questions about security and compliance. Reputable cloud providers invest heavily in robust security infrastructure that often surpasses what individual organizations can afford or manage in-house. These measures typically include advanced encryption protocols for data in transit and at rest, multi-factor authentication to prevent unauthorized access, and sophisticated intrusion detection and prevention systems.

Regular security audits, vulnerability assessments, and penetration testing are standard practices, ensuring that the platform remains resilient against evolving cyber threats. Moreover, cloud providers often adhere to stringent industry-specific security certifications and standards, such as ISO 27001, SOC 2, and GDPR, which provide an additional layer of assurance regarding the protection of sensitive financial information.Compliance with various regulatory frameworks is another critical aspect of cloud-hosted accounting ERPs.

For instance, financial institutions and publicly traded companies must adhere to regulations like Sarbanes-Oxley (SOX) or the General Data Protection Regulation (GDPR). Cloud ERP vendors typically design their platforms with these compliance requirements in mind, offering features that facilitate audit trails, segregation of duties, and data retention policies. This can significantly simplify the burden on accounting departments to meet these complex and often changing regulatory mandates.

By leveraging the expertise and infrastructure of cloud providers, businesses can offload much of the technical responsibility for maintaining compliance, allowing their finance teams to focus on strategic financial management rather than the intricacies of regulatory adherence.

The security of cloud-hosted accounting ERPs is a shared responsibility, with providers offering robust infrastructure and businesses implementing appropriate access controls and user management policies.

Facilitating Remote Work and Collaboration for Finance Teams

The inherent nature of cloud-based accounting ERP systems makes them a powerful enabler of remote work and enhanced collaboration for finance teams. With access granted through web browsers or dedicated applications, team members can log in and perform their duties from anywhere, at any time, provided they have a stable internet connection. This eliminates the geographical barriers that often hinder collaboration in traditional office setups.

For instance, a controller in one city can review and approve invoices submitted by an accounts payable clerk working remotely in another, in near real-time. This immediacy drastically reduces delays in processing and decision-making, contributing to overall operational efficiency.Cloud platforms also foster collaboration through shared access to data and workflows. Multiple users can simultaneously view and interact with the same financial information, ensuring everyone is working with the most up-to-date figures.

Features like centralized document management, integrated communication tools, and role-based access controls streamline teamwork. For example, a sales team member might upload a customer invoice directly into the ERP, which is then automatically routed to the accounting department for processing. This interconnectedness breaks down departmental silos and promotes a more cohesive and efficient financial operation. Furthermore, the ability to grant specific permissions means that sensitive data remains secure while still allowing necessary collaboration among relevant team members, promoting both efficiency and data integrity.

Potential Cost Implications of Adopting Cloud-Based Accounting ERP Solutions

The adoption of a cloud-based accounting ERP solution presents a distinct cost structure compared to traditional on-premises implementations, involving both initial and ongoing financial considerations. Initially, the capital expenditure is typically lower. Instead of purchasing expensive server hardware, software licenses, and paying for on-site installation and configuration, businesses often pay a subscription fee. This subscription model shifts the cost from a large, upfront capital outlay to a more manageable operational expense.

However, it’s crucial to factor in the costs associated with data migration, initial setup, customization to fit specific business processes, and user training. While these might not be as substantial as on-premises hardware costs, they are essential components of the initial investment.Ongoing costs are primarily driven by the subscription fees, which are usually calculated based on the number of users, the modules or features utilized, and the level of support required.

These recurring fees provide continuous access to the software, regular updates and maintenance performed by the vendor, and ongoing technical support. While this predictable operational expense can be beneficial for budgeting, it’s important to consider the total cost of ownership over several years. Over extended periods, the cumulative subscription fees could potentially exceed the cost of a one-time on-premises purchase, especially for very large organizations with stable user bases.

However, this needs to be weighed against the avoided costs of hardware maintenance, IT staff dedicated to server management, and the reduced risk of obsolescence associated with on-premises solutions. Furthermore, the flexibility to scale user licenses up or down can lead to cost savings if business needs fluctuate.

Cloud ERP adoption shifts IT spending from capital expenditure (CapEx) to operational expenditure (OpEx), offering predictable monthly or annual costs.

Integrating Supply Chain and Customer Relationship Management with Accounting ERP for Holistic Business Oversight

Moving beyond the core accounting functions, modern ERP systems offer a powerful pathway to integrate critical operational areas like supply chain management (SCM) and customer relationship management (CRM). This integration is not just about adding more features; it’s about creating a unified ecosystem where financial data is intrinsically linked to the physical flow of goods and the interactions with customers.

This holistic view allows businesses to make more informed decisions, streamline processes, and ultimately drive profitability by understanding the complete business picture, from raw materials to customer payment.

Supply Chain Management Integration for End-to-End Financial Transaction Visibility

The integration of supply chain management modules with an accounting ERP is fundamental to achieving true end-to-end visibility of financial transactions. When SCM modules are tightly coupled with the accounting system, every movement of goods, every procurement decision, and every inventory adjustment is directly reflected in the financial records. For instance, when a purchase order is generated for raw materials, the ERP system can immediately create a commitment for that expenditure, providing an early indication of future cash outflow.

As the goods are received, inventory levels are updated in real-time, and the corresponding accounts payable entries are generated. This ensures that the value of inventory on hand is accurately reflected in the balance sheet and that the cost of goods sold is precisely calculated as items are consumed in production or sold.Furthermore, this integration eliminates the data silos that often plague disparate SCM and accounting systems.

Instead of manual data entry or complex reconciliation between separate systems, the ERP acts as a single source of truth. This means that the financial impact of supplier lead times, potential stockouts, or production delays is immediately apparent. For example, if a supplier experiences a delay, the ERP can flag the potential impact on production schedules and associated costs, allowing for proactive adjustments to financial forecasts and operational plans.

Similarly, the valuation of work-in-progress and finished goods is dynamically updated as production progresses, providing an accurate, real-time view of asset values. This level of visibility is crucial for managing working capital effectively, identifying cost-saving opportunities within the supply chain, and ensuring compliance with financial reporting standards. The ability to trace the financial implications of every supply chain event, from the initial order to the final delivery, empowers businesses to optimize their entire operational and financial strategy.

Linking Customer Relationship Management Data to the Accounting ERP for Improved Invoicing and Revenue Recognition

Connecting customer relationship management (CRM) data to an accounting ERP system unlocks significant improvements in invoicing accuracy and revenue recognition. In essence, the CRM system acts as the front-end for customer interactions, capturing details about sales opportunities, quotes, and contracts, while the accounting ERP handles the financial backbone. When a sale is finalized in the CRM, this information can be seamlessly passed to the accounting ERP to trigger the invoicing process.

This eliminates manual data entry, reducing the risk of errors and ensuring that invoices are generated promptly and accurately based on the agreed-upon terms, pricing, and quantities. For example, a sales representative closing a deal in the CRM can initiate an invoice creation process within the ERP, pulling all relevant customer and order details automatically.The benefits extend to revenue recognition, particularly for complex contracts or subscription-based services.

By linking CRM contract data to the ERP, businesses can automate the recognition of revenue over the contract term, adhering to accounting standards like ASC 606 or IFRS 15. The ERP can track contract start and end dates, service delivery milestones, and payment schedules, ensuring that revenue is recognized at the appropriate times. This prevents under- or over-recognition of revenue, which can lead to financial misstatements and compliance issues.

For instance, a software company selling a multi-year subscription can have its ERP automatically amortize the contract value over the subscription period, aligning recognized revenue with the delivery of services. This integration also provides a clearer view of the sales pipeline and its financial implications. The ERP can forecast future revenue based on active deals in the CRM, allowing for more reliable financial planning and budgeting.

Ultimately, the synergy between CRM and accounting ERP transforms customer interactions into accurate, timely, and compliant financial transactions, enhancing both operational efficiency and financial integrity.

Workflow for Seamless Information Flow from Sales Orders to Financial Reconciliation

A well-integrated ERP system orchestrates a smooth workflow from the initial sales order to the final financial reconciliation, ensuring data accuracy and operational efficiency at every step. This process typically begins with the creation of a sales order, often initiated within the CRM module or directly in the sales order entry function of the ERP. Once the sales order is confirmed, it triggers a series of automated actions.Here’s a typical workflow:

- Sales Order Creation: A customer order is entered into the system, detailing the products or services, quantities, pricing, shipping information, and payment terms. This order is linked to the customer’s record.

- Inventory Allocation and Availability Check: The ERP system checks current inventory levels. If stock is available, it is allocated to the sales order, reducing the available quantity. If not, it may trigger a procurement or production request.

- Order Fulfillment and Shipping: Based on the sales order, a pick list is generated for the warehouse. Once items are picked and packed, shipping documents are created, and the order status is updated to ‘shipped’. This action often initiates the cost of goods sold calculation.

- Invoicing: Upon shipment confirmation, the ERP system automatically generates an invoice based on the sales order details and pricing. This invoice is sent to the customer, and a corresponding accounts receivable entry is created in the general ledger.

- Payment Processing: When the customer remits payment, it is recorded against the outstanding invoice in the accounts receivable module. This transaction updates the cash balance and reduces the accounts receivable balance.

- Revenue Recognition: For services or long-term contracts, the ERP system, guided by CRM contract data, recognizes revenue over time according to predefined schedules and accounting rules.

- Financial Reconciliation: At the end of a reporting period, all transactions related to sales, cost of goods sold, accounts receivable, and cash receipts are automatically compiled and presented in financial statements. The ERP facilitates the reconciliation of these sub-ledgers with the general ledger, ensuring that all financial data is accurate and balanced.

This automated flow minimizes manual intervention, reduces the likelihood of errors, and provides real-time visibility into order status, inventory levels, and financial positions. The ERP acts as the central hub, ensuring that information flows seamlessly and accurately from the point of sale through to the final financial reporting.

Unified Data Across Business Functions Enhancing Financial Forecasting Accuracy

The consolidation of data across disparate business functions within an integrated ERP system is a game-changer for financial forecasting accuracy. Traditionally, financial forecasts were often based on fragmented data from sales, operations, marketing, and finance departments, leading to inconsistencies and a lack of a unified view. An ERP system breaks down these silos, creating a single, consistent database that reflects the true state of the business.

When sales data, inventory levels, production schedules, procurement information, and customer payment patterns are all housed in one system, financial analysts have access to a wealth of interconnected information.This unified data environment allows for more sophisticated and accurate forecasting models. For instance, sales forecasts can be directly informed by real-time data on customer demand, market trends captured by the CRM, and the availability of inventory as managed by the SCM module.

If the SCM module indicates potential supply chain disruptions or extended lead times, this information can be fed directly into the sales forecast, prompting a more conservative projection or the identification of alternative sourcing strategies. Similarly, production data can provide insights into manufacturing capacity and lead times, which are crucial for forecasting the timely delivery of goods and, consequently, the timing of revenue recognition.Moreover, the ability to track historical performance across all integrated functions provides a robust foundation for predictive analytics.

The ERP can analyze patterns in customer purchasing behavior, seasonality of sales, and the impact of marketing campaigns on revenue. By correlating these operational metrics with financial outcomes, businesses can develop highly accurate forecasts for revenue, expenses, and cash flow. For example, a retail company might use its ERP to analyze the correlation between promotional activities, inventory turnover rates, and sales performance over several periods.

This analysis can then be used to predict the financial impact of future promotions with greater confidence.

Unified data within an ERP system transforms financial forecasting from an art based on fragmented information to a science grounded in comprehensive, real-time business intelligence.

This level of accuracy is invaluable for strategic decision-making, resource allocation, and risk management. It enables businesses to anticipate future financial needs, identify potential shortfalls or surpluses, and make proactive adjustments to their operational and financial strategies. The interconnectedness of data within an ERP ensures that financial forecasts are not just projections but informed predictions based on a complete understanding of the business’s operational realities.

Evaluating the Return on Investment and Future Trends in Accounting ERP Technology

As businesses navigate the complex landscape of financial management, understanding the true value derived from their accounting ERP systems is paramount. This involves a thorough assessment of both the quantifiable benefits and the less tangible, yet equally crucial, improvements. Beyond the initial investment, a strategic approach to evaluating the return on investment (ROI) ensures that ERP systems continue to deliver sustained value and drive organizational success.

Furthermore, the rapid evolution of technology necessitates a forward-looking perspective, anticipating how emerging trends will shape the future of accounting ERP and how businesses can best position themselves to capitalize on these advancements.

Calculating Return on Investment for Accounting ERP Systems

Determining the ROI of an accounting ERP implementation requires a comprehensive framework that captures both tangible and intangible benefits. Tangible returns are typically easier to quantify, stemming from direct cost savings and revenue enhancements. Intangible returns, while more challenging to measure, often represent the more profound and long-lasting advantages of a well-implemented ERP system, impacting operational efficiency, strategic decision-making, and overall business agility.

A robust ROI calculation provides a clear business case for the ERP investment and serves as a benchmark for future performance.A structured approach to calculating ROI involves identifying and quantifying various cost and benefit categories. This process should begin with a detailed analysis of the initial investment, encompassing software licensing, hardware upgrades, implementation services, data migration, and employee training. Ongoing costs, such as maintenance fees, subscription charges, and additional training, must also be factored in.On the benefits side, tangible returns can be categorized as follows:

- Cost Reductions: This includes decreased manual labor due to automation, reduced errors leading to fewer reworks and write-offs, optimized inventory management minimizing carrying costs and obsolescence, and streamlined procurement processes resulting in better vendor terms and bulk discounts. For instance, a manufacturing company might see a 15% reduction in inventory holding costs after implementing an ERP system that provides real-time visibility into stock levels and demand forecasting.

- Revenue Enhancements: ERP systems can boost revenue through improved order processing accuracy, faster invoicing and collections, enhanced customer service leading to increased retention and repeat business, and better sales forecasting enabling more effective resource allocation and targeted marketing campaigns. A retail business might experience a 5% increase in sales due to faster checkout processes and more accurate inventory availability displayed to customers.

- Productivity Gains: Automation of repetitive tasks, such as data entry, reconciliation, and report generation, frees up accounting staff to focus on more strategic activities. This can translate into a significant increase in the number of transactions processed per employee or a reduction in the time required to close financial periods. A financial services firm might report a 20% increase in the efficiency of its accounts payable department after automating invoice processing.

Intangible returns, though harder to assign a precise monetary value, are critical to the overall success of an ERP system. These include:

- Improved Decision-Making: Access to real-time, accurate financial data enables management to make more informed and timely decisions. This can lead to better strategic planning, risk management, and operational adjustments. For example, having up-to-the-minute profitability reports by product line can guide decisions on product development or discontinuation.

- Enhanced Compliance and Control: ERP systems provide robust audit trails, segregation of duties, and standardized processes, significantly improving internal controls and facilitating compliance with regulatory requirements. This reduces the risk of fraud and penalties.

- Increased Agility and Scalability: A well-integrated ERP system allows businesses to adapt more quickly to market changes, scale operations efficiently, and integrate new acquisitions or business units. This flexibility is invaluable in a dynamic business environment.

- Better Collaboration: Centralized data and workflows foster better communication and collaboration across departments, breaking down information silos and improving overall operational synergy.

- Enhanced Customer Satisfaction: Accurate order fulfillment, timely invoicing, and efficient issue resolution contribute to a better customer experience, fostering loyalty and positive word-of-mouth.

The formula for calculating ROI can be expressed as:

ROI = [(Total Benefits – Total Costs) / Total Costs] – 100%

It is crucial to establish a baseline for key metrics before implementation and to track these metrics consistently post-implementation to accurately measure the realized benefits.

Emerging Technologies Transforming Accounting ERP

The accounting ERP landscape is on the cusp of a significant transformation, driven by the integration of cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML). These advancements are moving beyond basic automation to offer predictive capabilities, intelligent insights, and a more proactive approach to financial management. By embedding AI and ML, accounting ERP systems are becoming more sophisticated, capable of handling complex tasks, identifying anomalies, and optimizing processes in ways previously unimaginable.

This evolution promises to enhance efficiency, accuracy, and strategic value for businesses.Artificial intelligence and machine learning are poised to revolutionize numerous aspects of accounting ERP functionalities. AI’s ability to process and analyze vast datasets, learn from patterns, and make intelligent decisions is particularly relevant to accounting. Machine learning algorithms can be trained on historical financial data to identify trends, predict future outcomes, and flag potential risks or opportunities.Key areas where AI and ML are making an impact include:

- Automated Data Entry and Validation: AI-powered optical character recognition (OCR) and natural language processing (NLP) can extract data from unstructured documents like invoices, receipts, and bank statements with high accuracy, significantly reducing manual data entry. ML algorithms can then validate this data against predefined rules and historical patterns, flagging discrepancies for human review. For instance, an AI system can learn to recognize different invoice formats from various vendors and automatically extract relevant fields like vendor name, invoice number, date, and amounts.

- Fraud Detection and Anomaly Identification: ML algorithms excel at identifying unusual patterns or outliers in financial transactions that may indicate fraudulent activity or errors. By continuously learning from transaction data, these systems can detect subtle anomalies that might be missed by traditional rule-based systems. A real-world example is an ML model flagging a series of unusually large payments to a new vendor that deviates from the company’s typical spending patterns.

- Predictive Analytics and Forecasting: AI and ML can enhance forecasting accuracy for revenue, expenses, and cash flow by analyzing historical data, market trends, and external economic indicators. This enables businesses to make more informed strategic decisions and proactively manage financial resources. Companies can use predictive models to forecast sales for the next quarter with greater precision, allowing for better inventory planning and resource allocation.

- Intelligent Process Automation (IPA): Beyond simple task automation, IPA combines AI, ML, and robotic process automation (RPA) to automate entire business processes. This includes complex workflows like end-to-end procure-to-pay or order-to-cash cycles, making them more efficient and less prone to human error. An example is an IPA solution that automatically processes customer orders, generates invoices, and updates inventory levels without any human intervention.

- Enhanced Audit and Compliance: AI can assist in continuous auditing by analyzing transactions in real-time, identifying compliance breaches, and generating audit reports more efficiently. This proactive approach helps businesses stay ahead of regulatory requirements and reduces the burden of manual audits. For instance, an AI tool could continuously monitor for compliance with tax regulations across different jurisdictions.

- Personalized Financial Advice and Support: AI-powered chatbots and virtual assistants can provide instant support to users, answering common queries about financial data, system functionalities, and reporting. In the future, AI might even offer personalized recommendations for financial optimization.

The integration of AI and ML into accounting ERP systems is not just about improving existing functionalities; it’s about fundamentally changing how financial data is managed, analyzed, and leveraged for strategic advantage. Businesses that embrace these technologies will be better equipped to navigate complexity, drive efficiency, and achieve superior financial performance.

Adapting Accounting ERP to Complex Regulatory Environments

The increasing complexity of global regulatory environments presents a significant challenge for businesses, demanding greater transparency, accuracy, and adherence to diverse compliance standards. Accounting ERP systems are evolving rapidly to meet these demands, incorporating features and functionalities that enable organizations to navigate this intricate landscape effectively. The focus is shifting towards systems that not only record financial transactions but also actively support compliance, mitigate risks, and provide robust audit trails.Modern accounting ERP systems are being designed with compliance as a core tenet, moving beyond basic reporting to offer proactive solutions for regulatory adherence.

This evolution is driven by several factors, including the proliferation of new accounting standards, stricter data privacy laws, and increased scrutiny from regulatory bodies worldwide.Key ways accounting ERP systems are adapting to complex regulatory environments include:

- Multi-Jurisdictional Compliance: Many ERP systems now offer built-in support for multiple accounting standards (e.g., IFRS, GAAP) and tax regulations across different countries and regions. This allows multinational corporations to maintain a single source of truth for financial data while adhering to local compliance requirements. For example, a company operating in both the US and Europe can configure its ERP to comply with both US GAAP and IFRS reporting standards simultaneously.

- Enhanced Audit Trails and Data Integrity: Robust audit trails are crucial for regulatory compliance. ERP systems are enhancing their capabilities to log every transaction, modification, and access attempt, providing a clear and immutable record of all financial activities. This ensures data integrity and facilitates quick and efficient audits. A well-designed audit trail can track who accessed a particular financial record, when they accessed it, and what changes were made.

- Automated Compliance Checks and Alerts: Advanced ERP systems are incorporating automated checks to ensure transactions comply with predefined regulatory rules. When a potential non-compliance is detected, the system can generate alerts, flagging the issue for immediate attention and correction. For instance, a system might alert an accounts payable clerk if an invoice amount exceeds a predefined threshold for approval without proper authorization.

- Segregation of Duties (SoD) Enforcement: To prevent fraud and errors, ERP systems are implementing sophisticated SoD controls. These controls ensure that no single individual has control over all aspects of a financial transaction. The system can be configured to prevent users from performing conflicting tasks, such as creating a vendor and approving payments to that same vendor.

- Real-time Reporting and Dashboards: Regulatory bodies often require timely and accurate reporting. ERP systems provide real-time financial dashboards and reporting tools that can generate compliant reports on demand. This significantly reduces the time and effort required for month-end and year-end closing processes and ensures that up-to-date information is available for regulatory submissions. For example, a company can generate a real-time report on its compliance with data privacy regulations like GDPR.

- Data Privacy and Security Features: With regulations like GDPR and CCPA, data privacy is a critical concern. ERP systems are incorporating advanced security features, including encryption, access controls, and data masking, to protect sensitive financial and personal information. They also provide tools for managing data consent and fulfilling data subject access requests.

- Support for Emerging Regulations: As new regulations emerge, ERP vendors are committed to updating their systems to incorporate the necessary functionalities. This proactive approach ensures that businesses can adapt to evolving compliance landscapes without needing extensive custom development. For instance, when new environmental, social, and governance (ESG) reporting requirements are introduced, ERP systems will be updated to capture and report on relevant ESG data.

By leveraging these evolving ERP capabilities, businesses can transform compliance from a burdensome obligation into a strategic advantage, ensuring operational integrity and fostering trust with stakeholders and regulatory authorities.

Leveraging Accounting ERP for Future Market Dynamics and Technological Advancements

The future of business is characterized by rapid change, driven by evolving market dynamics, disruptive technologies, and shifting consumer expectations. In this dynamic environment, accounting ERP systems are no longer just tools for financial record-keeping; they are becoming strategic platforms that empower businesses to adapt, innovate, and thrive. By embracing the full potential of their ERP systems and staying abreast of technological advancements, organizations can build resilience, foster agility, and secure a competitive edge in the years to come.Businesses can strategically leverage their accounting ERP systems to navigate future market shifts and technological disruptions by focusing on adaptability, foresight, and continuous improvement.

The core of this strategy lies in viewing the ERP as a central nervous system for the organization, enabling seamless integration of data and processes across all functions.Key strategies for leveraging accounting ERP for future readiness include:

- Embracing a Cloud-First Strategy: Cloud-based ERP solutions offer unparalleled flexibility, scalability, and accessibility. They allow businesses to quickly adapt to changing demands, access the latest features and updates without significant IT overhead, and facilitate remote workforces. This agility is crucial for responding to unexpected market shifts or scaling operations rapidly to meet surges in demand. For example, a business experiencing rapid growth can easily scale its ERP infrastructure in the cloud to accommodate increased transaction volumes.